by YourQBGuru | Sep 17, 2024 | Blog

Your Month-by-Month Guide to Staying on Top of Bookkeeping Keeping up with bookkeeping and tax deadlines can feel overwhelming, especially when you’re trying to run a business. That’s why we created the YourQBGuru Bookkeeping Calendar — to help you stay organized,...

by YourQBGuru | Jun 12, 2024 | Blog

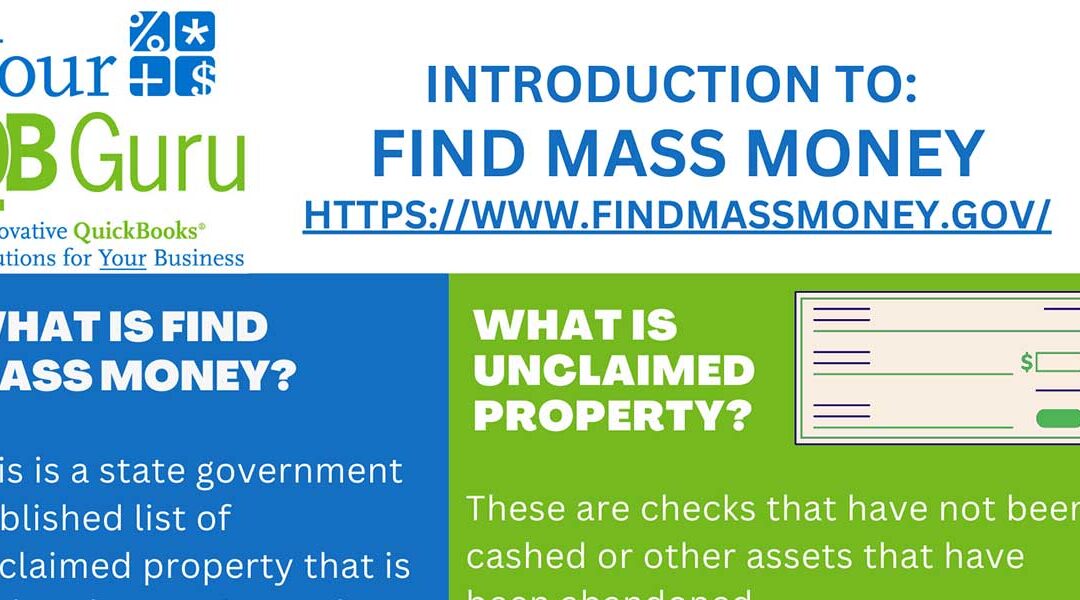

Have You Checked for Unclaimed Money in Massachusetts? You’d be surprised how often money goes missing — old vendor checks, forgotten client refunds, even random overpayments. If it’s been sitting in your books for years, there’s a good chance it’s what...

by YourQBGuru | Mar 28, 2024 | Blog

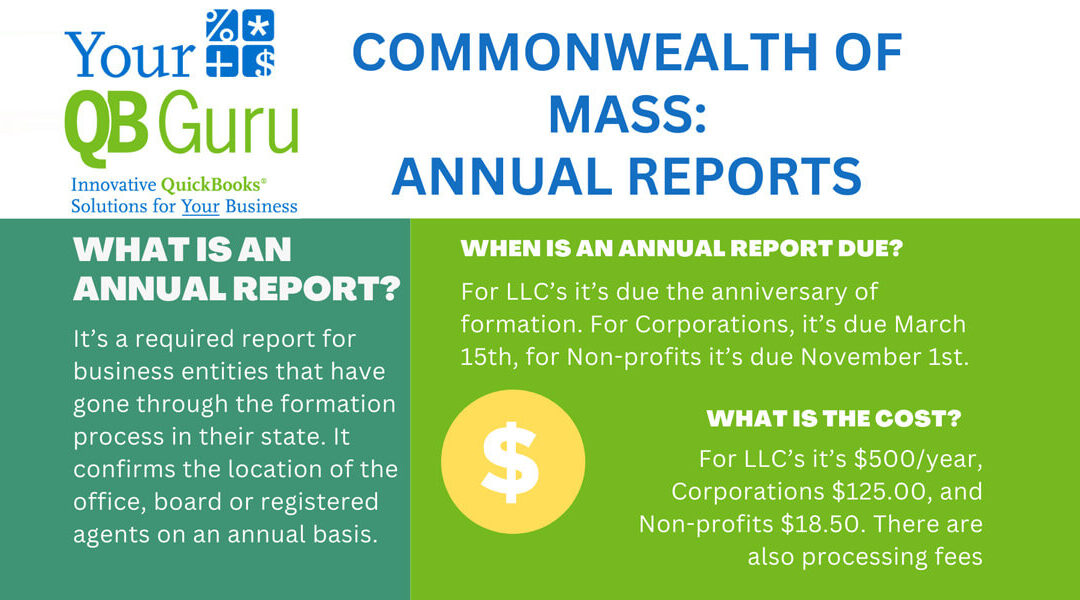

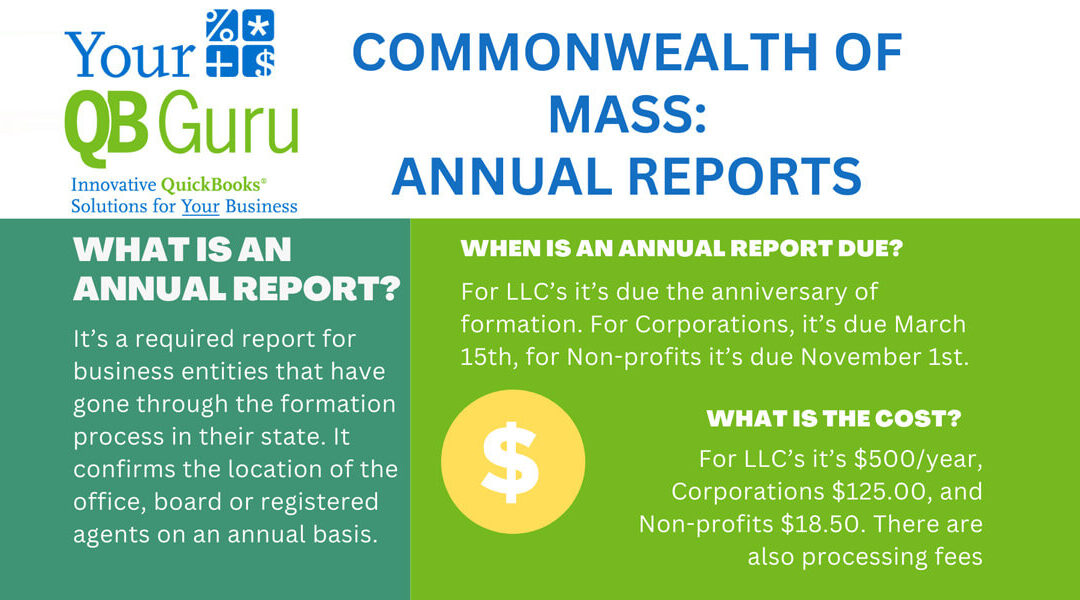

Understanding Annual Reports for Massachusetts Businesses Part of becoming a business entity in Massachusetts involves registering with the Secretary of the Commonwealth. Once registered, that status must be maintained through annual filings—specifically, the Annual...

by YourQBGuru | Feb 7, 2024 | Blog

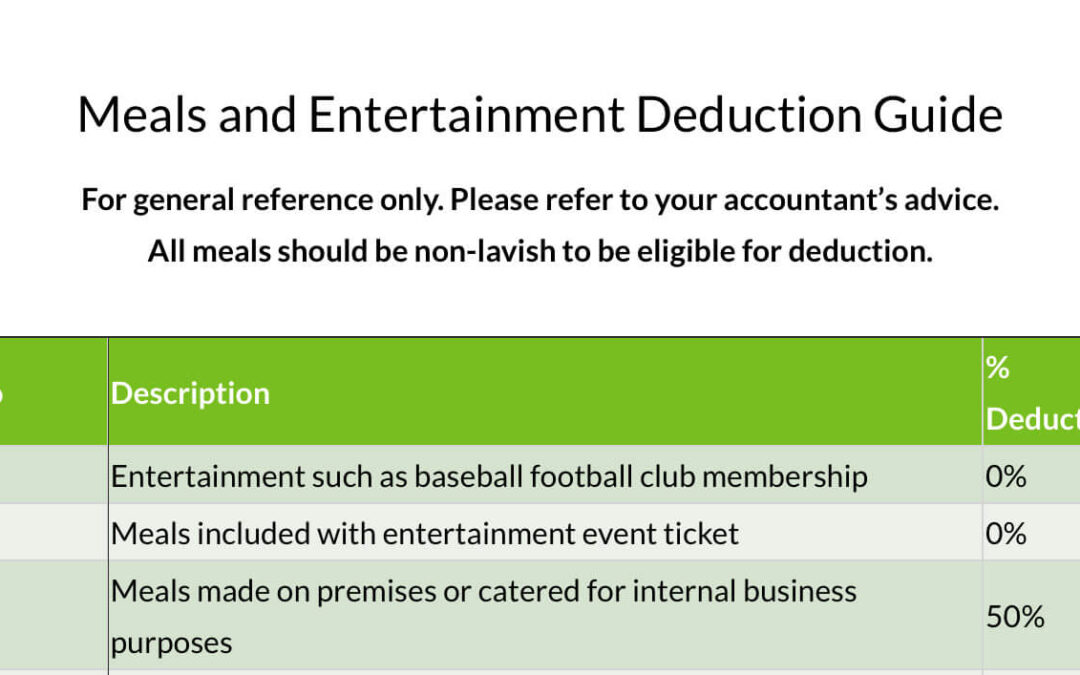

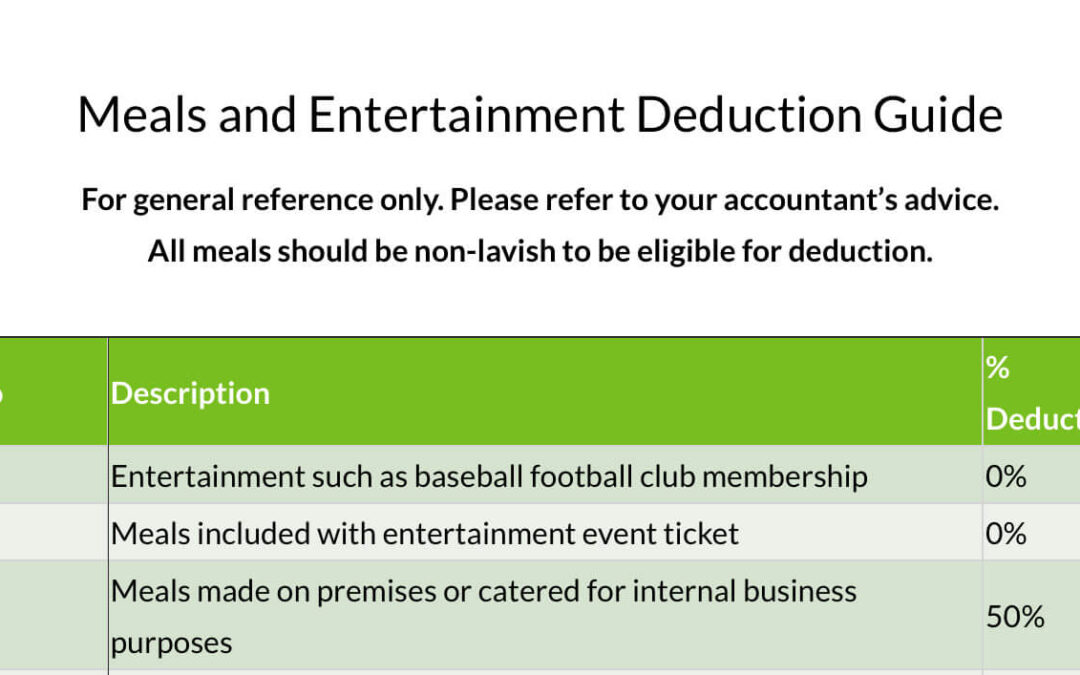

For general reference only. Please refer to your accountant’s advice. All meals should be non-lavish to be eligible for deduction. Who Description % Deductable All Entertainment such as baseball football club membership 0% All Meals included with entertainment event...

by YourQBGuru | Feb 7, 2024 | Blog

Let’s Talk 1099s — Specifically, the 1099-NEC For this post, we’re focusing on the 1099-NEC (Nonemployee Compensation)—a form you’re required to send to independent contractors by January 31st each year. A contractor is anyone you pay for a service who is not your...