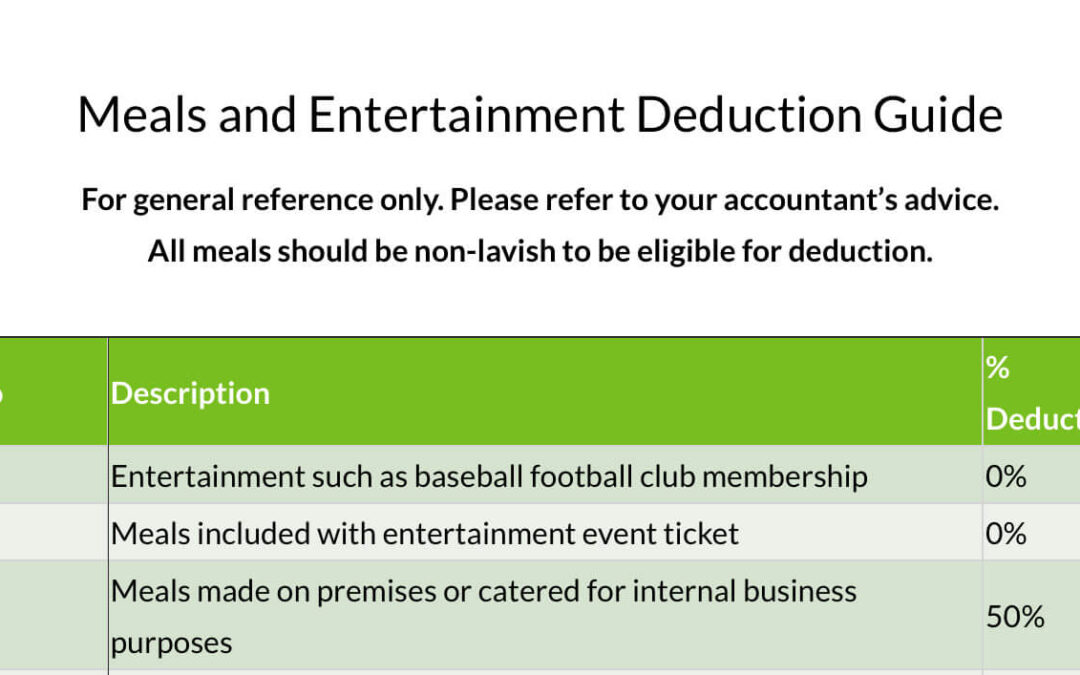

For general reference only. Please refer to your accountant’s advice.

All meals should be non-lavish to be eligible for deduction.

| Who | Description | % Deductable |

|---|---|---|

| All | Entertainment such as baseball football club membership | 0% |

| All | Meals included with entertainment event ticket | 0% |

| All | Meals made on premises or catered for internal business purposes | 50% |

| Customer | Year-end party | 0% |

| Customer | Non-lavish client business meal | 50% |

| Employee | Meals purchased at an entertainment event | 50% |

| Employee | Travel either purchased or prepared in hotel room | 50% |

| Employee | On-premises coffee and snacks | 50% |

| Employee | Non-lavish meals purchased during employee travel in pursuit of business or trade | 50% |

| Employee | Year end party company event (picnic) or outing for employees and spouses | 100% |

| Employee | On premises shift meals | 100% |

| Employee | Meals made on premises for marketing presentation | 100% |

| General Public | Food that is offered for free to the general public | 100% |

| General Public | Restaurant meals (non-lavish) | 100% |

| Potential Client | Restaurant meals (non-lavish) | 50% |