Configure Sales Tax in Your Bookkeeping Software

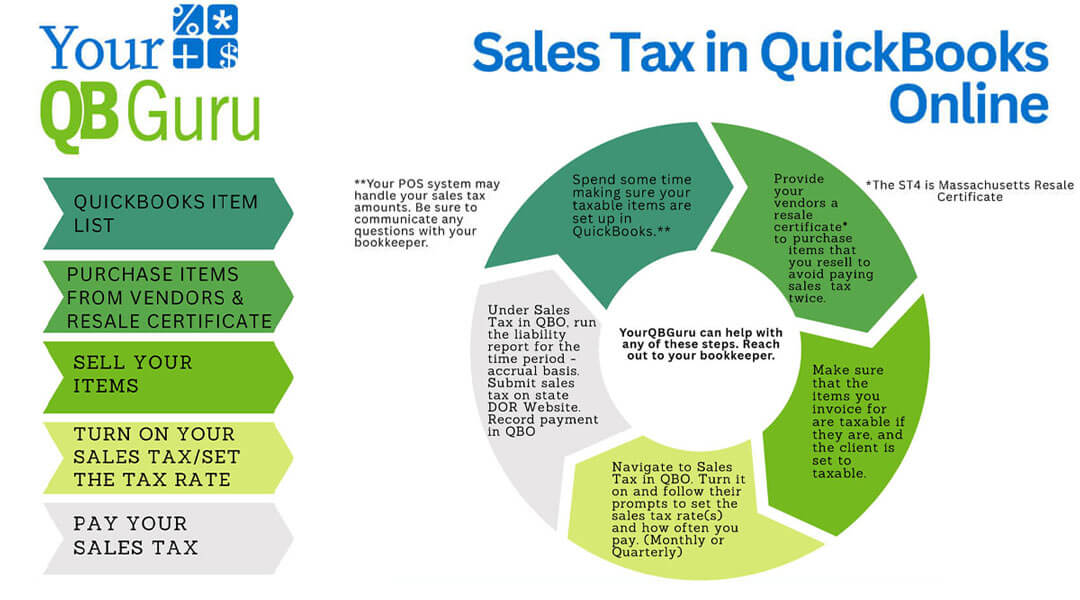

Sales tax can feel like one of those “small” tasks that turns into a big headache—especially if you’re not set up correctly from the start. If your business sells taxable goods or services, tracking and paying sales tax accurately is critical. That’s where your setup in Bookkeeping Software comes in—and this blog post walks you through the key steps, just like in our handy infographic.

1. Start with the Right Setup: Your Item List

Before you even make a sale, make sure your products and services are properly listed in QBO. Each item should be clearly marked as taxable or non-taxable depending on your local and state laws. If you’re using a POS system, double-check that it integrates properly with QBO and tracks tax correctly.

2. Don’t Forget Your Resale Certificate

If you’re buying inventory or products you plan to resell, you likely don’t need to pay sales tax upfront. Instead, you provide your vendor with a resale certificate—like Massachusetts’ ST-4—to avoid paying tax twice. Skipping this step could cost you more than you think.

3. Selling Your Items

Once your products are set up, be sure your customers are set as taxable (if applicable), and that your invoices reflect whether or not an item is taxable. Your Bookkeeping software can help calculate the tax—but only if your setup is accurate!

4. Turn on Sales Tax in Your Software

Go to the Sales Tax Center and follow the steps to turn it on. You’ll be prompted to set your tax rate(s), and you’ll choose whether you file monthly or quarterly, depending on your state’s requirements.

5. Pay Your Sales Tax

When it’s time to file, go back into the Sales Tax Center, run the Liability Report (accrual basis) for your reporting period, and use that info to submit your payment on your state’s Department of Revenue website. Then, make sure to record the payment in your software so your books stay clean and up to date.

Need Help? That’s What We’re Here For.

Sales tax mistakes are easy to make—and costly to fix. Whether you’re setting things up for the first time or just want someone to review your process, YourQBGuru is here to help. We specialize in QuickBooks setups and making sure your bookkeeping supports your business, not the other way around.

📞508-655-2255

🌐www.yourqbguru.com