Let’s Talk 1099s — Specifically, the 1099-NEC

For this post, we’re focusing on the 1099-NEC (Nonemployee Compensation)—a form you’re required to send to independent contractors by January 31st each year.

A contractor is anyone you pay for a service who is not your employee. Think freelance designers, marketing consultants, repair technicians, or subcontractors.

How Can You Make Sure You’re 1099-Ready?

Here are a few best practices to make January less stressful and your records more accurate:

📝 1. Collect a W-9 from Every Contractor

Have each new contractor fill out a W-9 form before they start working for you. The W-9 provides key details like their legal name, tax classification, and taxpayer ID.

⚠️ Security tip: Contractors often use their Social Security Number on this form, so don’t send it via email. Use a secure portal, encrypted upload, or other protected method to share it with your bookkeeper.

📊 2. Stay on Top of Bookkeeping—Especially at Year-End

Accurate 1099s rely on clean books. Make sure you:

- Send your bookkeeper statements, receipts, and liability documents regularly.

- Schedule a check-in toward year-end to review open questions.

- Respond promptly to questions—your bookkeeper can’t fix what they don’t know.

💸 3. Track Outstanding Payments

Let your bookkeeper know about uncashed checks—especially those written to contractors. If these payments aren’t recorded correctly, your contractor’s 1099 could be incomplete or incorrect.

If Your Books Are in Order, 1099s Are Easy!

If your bookkeeper has:

- Entered all your contractor payments

- Received a W-9 for each contractor

… then 1099s are straightforward to prepare.

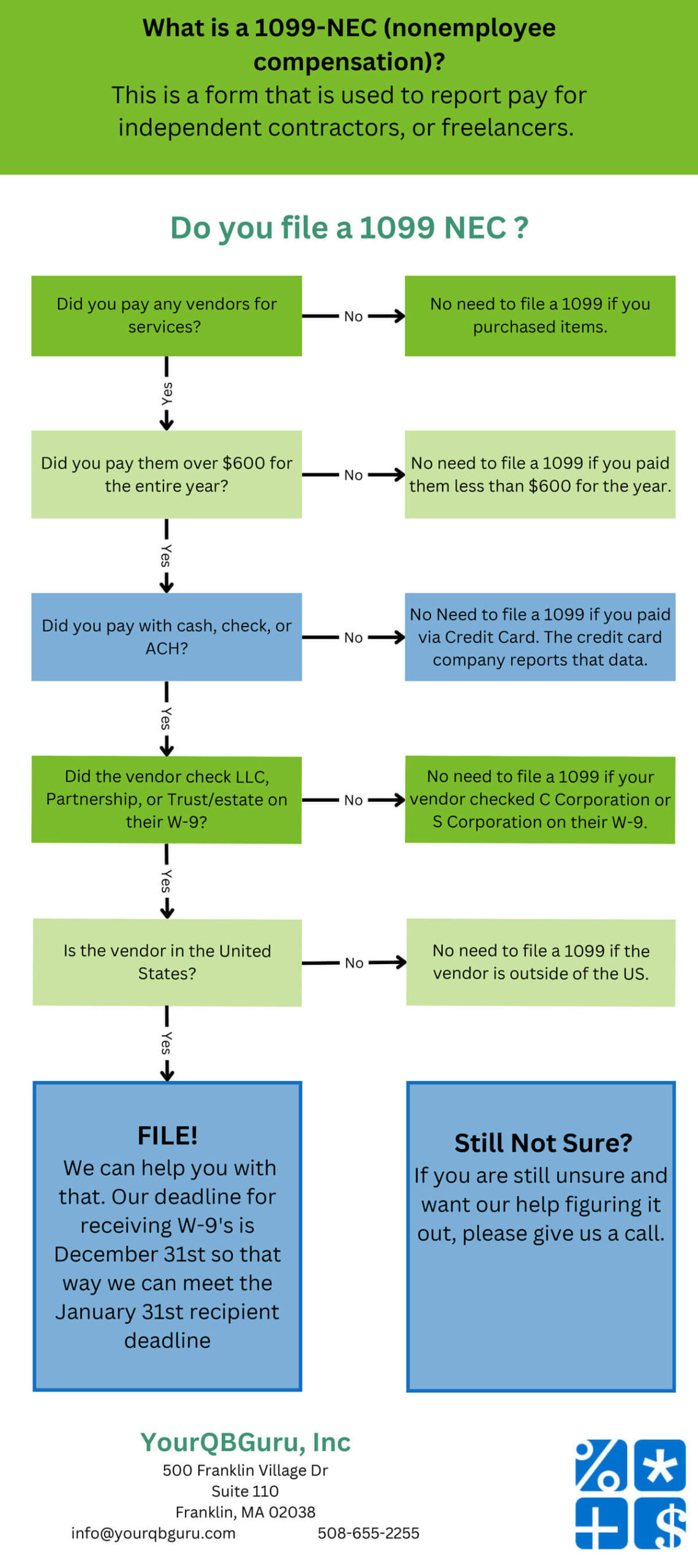

Who Gets a 1099-NEC? Use Our Handy Flowchart!

Not sure if someone qualifies? Here are a few factors to consider:

- Were they paid $600 or more during the year?

- Were they paid via bank transfer, cash, or check (not credit cards or PayPal)?

- Are they an LLC, sole proprietor, or partnership (not a corporation)?

- Are they based in the U.S.?

Still unsure? That’s okay—reach out to your bookkeeper. It’s better to ask early than scramble later.